library(forecast)

library(lubridate)

library(zoo)

library(dplyr)- 데이터 source: http://data.krx.co.kr/contents/MDC/MDI/mdiLoader/index.cmd?menuId=MDC0201020203

참고 https://velog.io/@isitcake_yes/mlarimastockprediction

import

data

kakao <- read.csv("kakaodata_1206.csv", fileEncoding = "ISO-8859-1")head(kakao)| ÀÏÀÚ | Á... | X.ëºñ | µî.ô.ü | X.Ã.. | X.í.. | Àú.. | X.Å.... | X.Å...ë.Ý | X.Ã..ÃÑ.. | X.óÀåÁÖ.Ä.ö | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 1 | 2023/12/06 | 50900 | 100 | 0.20 | 50700 | 51100 | 50200 | 735503 | 37302792200 | 2.262484e+13 | 444495970 |

| 2 | 2023/12/05 | 50800 | 0 | 0.00 | 50700 | 51200 | 50200 | 1142447 | 57992282100 | 2.258040e+13 | 444495970 |

| 3 | 2023/12/04 | 50800 | 1100 | 2.21 | 49800 | 51300 | 49750 | 1785113 | 90624610300 | 2.258040e+13 | 444495970 |

| 4 | 2023/12/01 | 49700 | -800 | -1.58 | 50400 | 50400 | 49650 | 1105367 | 55174771850 | 2.209145e+13 | 444495970 |

| 5 | 2023/11/30 | 50500 | 0 | 0.00 | 50200 | 50900 | 50000 | 1613598 | 81271347200 | 2.244705e+13 | 444495970 |

| 6 | 2023/11/29 | 50500 | -600 | -1.17 | 50800 | 51300 | 50100 | 1284120 | 65153113600 | 2.244705e+13 | 444495970 |

colnames(kakao) <- c("일자","종가","대비","등락률","시가","고가","저가","거래량","거래대금","시가총액","상장주식수")kakao <- kakao[order(kakao$일자),]

rownames(kakao) <- NULL

head(kakao)| 일자 | 종가 | 대비 | 등락률 | 시가 | 고가 | 저가 | 거래량 | 거래대금 | 시가총액 | 상장주식수 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 1 | 2023/01/02 | 52700 | -400 | -0.75 | 53600 | 53800 | 52400 | 887667 | 46979376500 | 2.347313e+13 | 445410387 |

| 2 | 2023/01/03 | 53300 | 600 | 1.14 | 52400 | 53500 | 51400 | 1420569 | 74588286800 | 2.374037e+13 | 445410387 |

| 3 | 2023/01/04 | 55700 | 2400 | 4.50 | 53200 | 56000 | 53100 | 2241411 | 123346180300 | 2.480936e+13 | 445410387 |

| 4 | 2023/01/05 | 57700 | 2000 | 3.59 | 55800 | 58200 | 55700 | 3046064 | 175103778900 | 2.570018e+13 | 445410387 |

| 5 | 2023/01/06 | 57200 | -500 | -0.87 | 57200 | 58000 | 56500 | 1420345 | 81326211100 | 2.547747e+13 | 445410387 |

| 6 | 2023/01/09 | 61100 | 3900 | 6.82 | 58700 | 61200 | 58300 | 3482961 | 208443993900 | 2.721457e+13 | 445410387 |

tail(kakao)| 일자 | 종가 | 대비 | 등락률 | 시가 | 고가 | 저가 | 거래량 | 거래대금 | 시가총액 | 상장주식수 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 225 | 2023/11/29 | 50500 | -600 | -1.17 | 50800 | 51300 | 50100 | 1284120 | 65153113600 | 2.244705e+13 | 444495970 |

| 226 | 2023/11/30 | 50500 | 0 | 0.00 | 50200 | 50900 | 50000 | 1613598 | 81271347200 | 2.244705e+13 | 444495970 |

| 227 | 2023/12/01 | 49700 | -800 | -1.58 | 50400 | 50400 | 49650 | 1105367 | 55174771850 | 2.209145e+13 | 444495970 |

| 228 | 2023/12/04 | 50800 | 1100 | 2.21 | 49800 | 51300 | 49750 | 1785113 | 90624610300 | 2.258040e+13 | 444495970 |

| 229 | 2023/12/05 | 50800 | 0 | 0.00 | 50700 | 51200 | 50200 | 1142447 | 57992282100 | 2.258040e+13 | 444495970 |

| 230 | 2023/12/06 | 50900 | 100 | 0.20 | 50700 | 51100 | 50200 | 735503 | 37302792200 | 2.262484e+13 | 444495970 |

해당 데이터를 다운받을 때는, 12/6까지 있었는데, 원활한 데이터 분석을 위해서 1~11월의 데이터만 사용 5개의 12월 데이터는 빼고..

1 ~ 10월에서 1 ~ 8월은 train data, 9~10월은 test data로 해볼까?

11월은 예측해보고.. 비교해보자

- kakao는 주식 데이터이기 때문에 공휴일은 거래 값이 없다.

엑셀 데이터에는 아예 그 값이 비어진 상태로 구성되어 있음.

예를 들어

1/2

1/3

1/4

1/5

1/6

1/9

1/10

이렇게 구성되어 있다. 음… 일단 결측값은 없는 거니까 1)그냥 돌리기(ㅎㅎ사실 이게 맞긴한듯) 2) 비어있는 공휴일에 대체 값을 집어넣기.. MA값을 집어 넣어도 괜찮을 것 같고 전날의 종가와 다음날의 시작값의 평균값을 넣어도 될거같기도 하다.

calendar <- seq(as.Date("2023-01-01"), as.Date("2023-11-30"), by = "days")date_na <- as.Date(setdiff(calendar, as.Date(kakao$일자)), origin= "1970-01-01")length(date_na)1월 1일부터 11월 30일까지 108개의 결측값이 있음. 정말 많군!

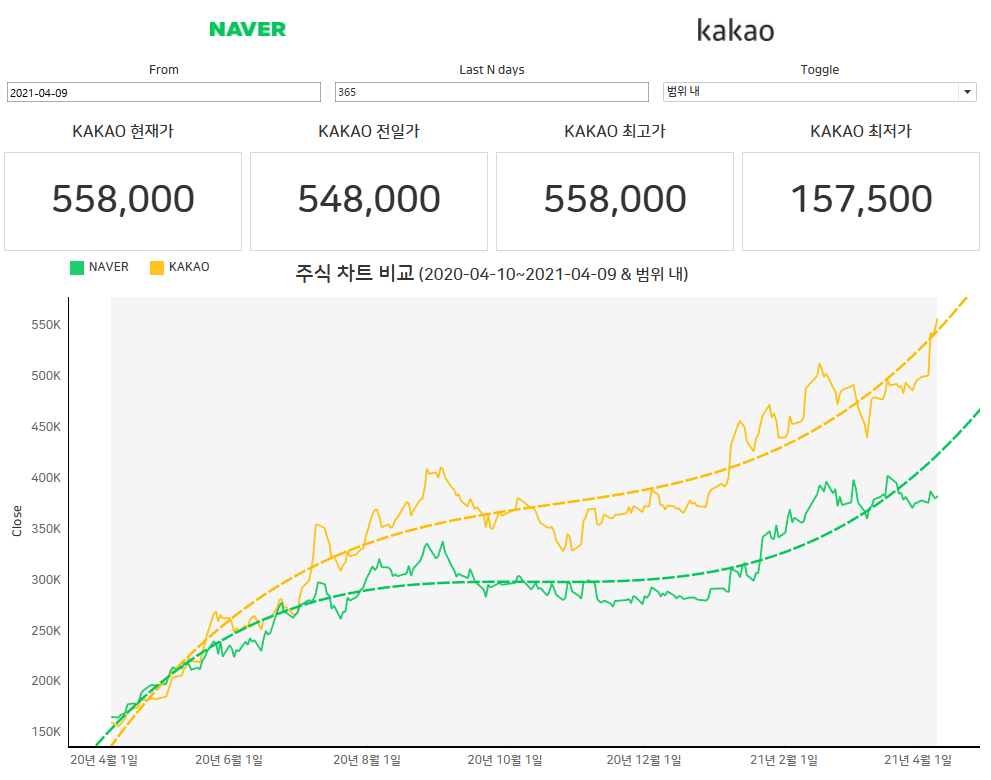

- 3년의 카카오 데이터 봉차트

- 내가 있는 곳은…. 일봉 주봉 월봉 1년봉으로도 보이지 않는다. 3년을 해야 보이는 고점…

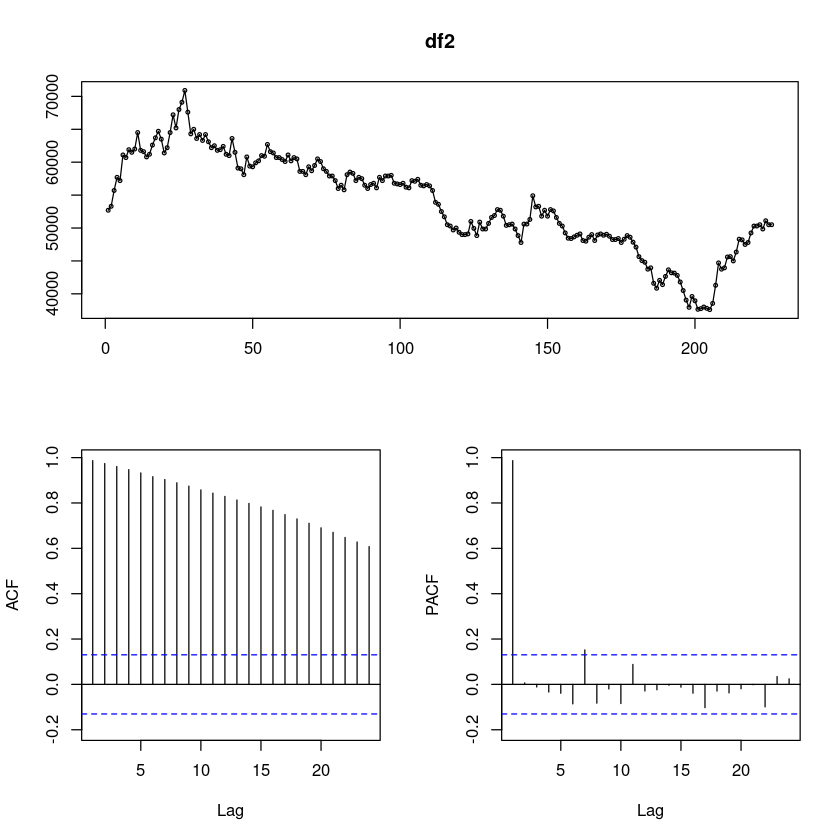

df <- head(kakao, 226)df2 <- df$종가- 시계열 분석 시작~!

forecast::tsdisplay(df2)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

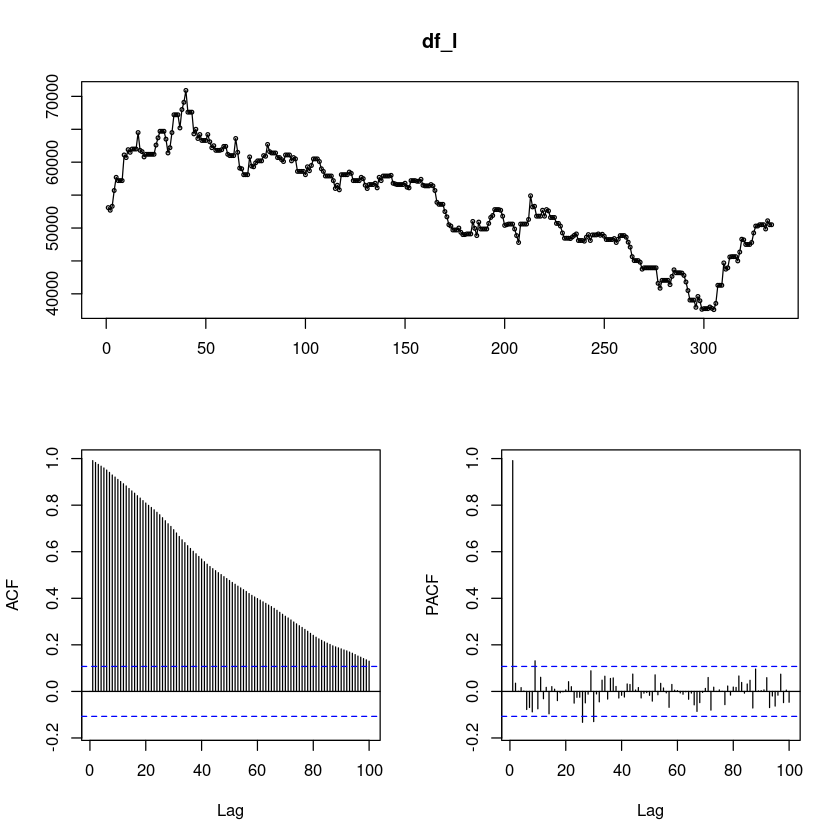

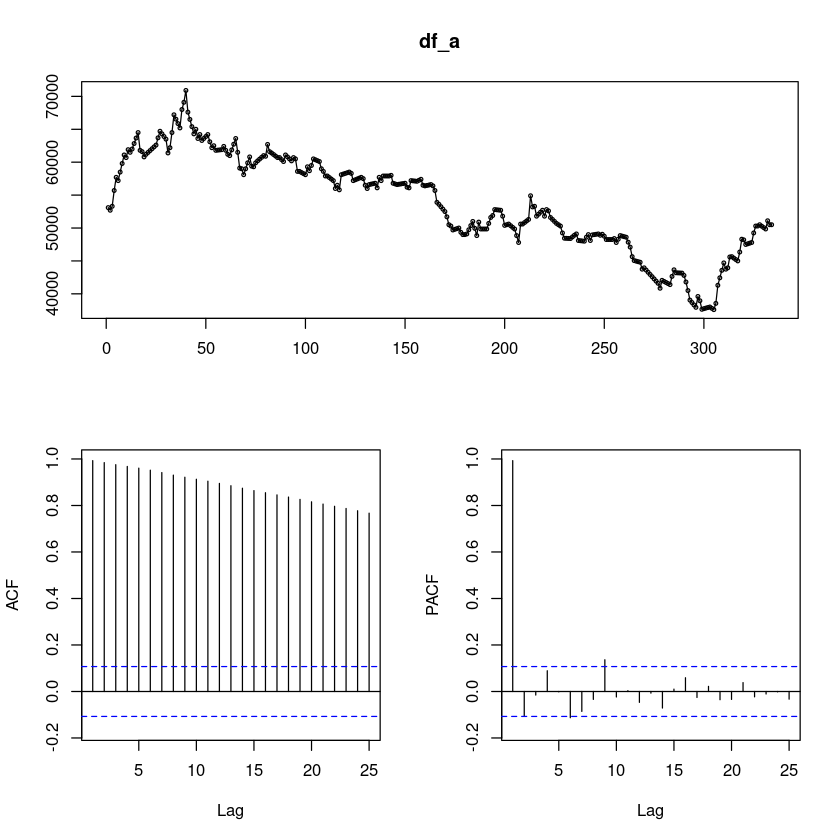

kakao의 종가를 기준으로, 시도표를 그려보았다.

kakao의 하락세…^^ 로 인해서 추세가 있어보인다!

ACF가 천천히 감소하고 있어서, 확률적 추세가 있어보인다. 차분이 필요할 것 같다.

PACF는 1차시에만 유효하고 그 이후에는 다 절단이다. AR(1)모형을 생각해 볼 수 있을 것 같다.

일자에 NA값 적용이 되지않아서 그런가? 그래서 계절성분이 보이지 않는 것도 같다.

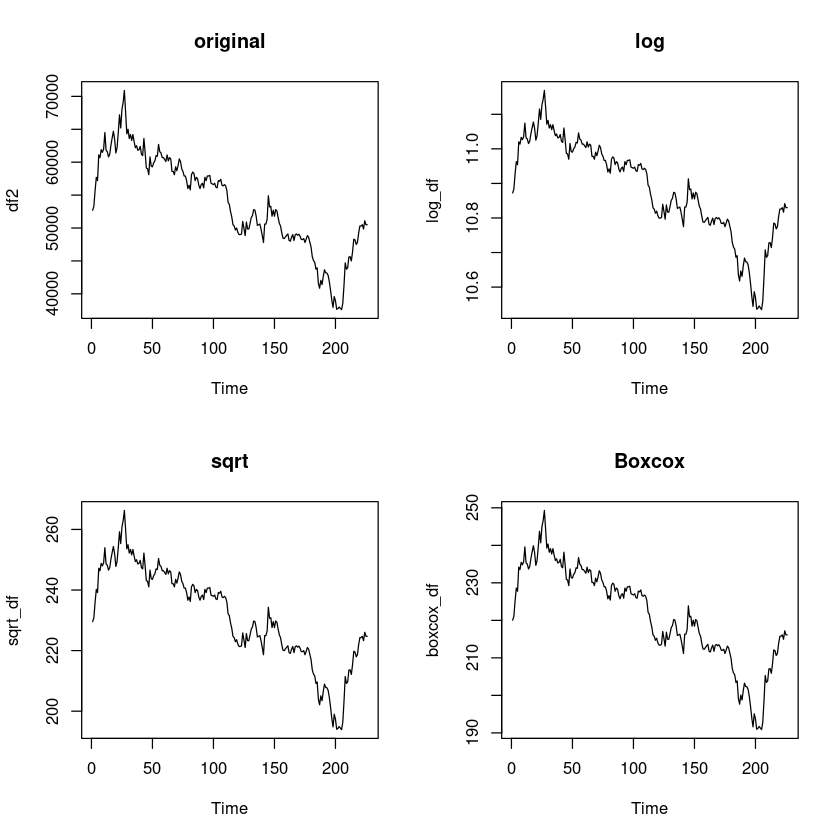

분산이 크다. 변환이 필요할 듯 보인다. 분산안정화를 진행하자.

변수변환

log_df = log(df2)

sqrt_df = sqrt(df2)

boxcox_df = forecast::BoxCox(df2,lambda= forecast::BoxCox.lambda(df2))forecast::BoxCox.lambda(df2)par(mfrow=c(2,2))

plot.ts(df2, main = "original")

plot.ts(log_df, main = 'log')

plot.ts(sqrt_df, main = 'sqrt')

plot.ts(boxcox_df, main = 'Boxcox')

t = 1:length(df2)

lmtest::bptest(lm(df2~t)) #H0 : 등분산이다

lmtest::bptest(lm(log_df~t))

lmtest::bptest(lm(sqrt_df~t))

lmtest::bptest(lm(boxcox_df~t))

studentized Breusch-Pagan test

data: lm(df2 ~ t)

BP = 2.7869, df = 1, p-value = 0.09504

studentized Breusch-Pagan test

data: lm(log_df ~ t)

BP = 15.269, df = 1, p-value = 9.323e-05

studentized Breusch-Pagan test

data: lm(sqrt_df ~ t)

BP = 8.2031, df = 1, p-value = 0.004182

studentized Breusch-Pagan test

data: lm(boxcox_df ~ t)

BP = 9.3125, df = 1, p-value = 0.002276반전.. 값이 작긴 하지만 원본데이터가 등분산으로 나왔다.

원본 데이터로 분석을 진행해보겠다.

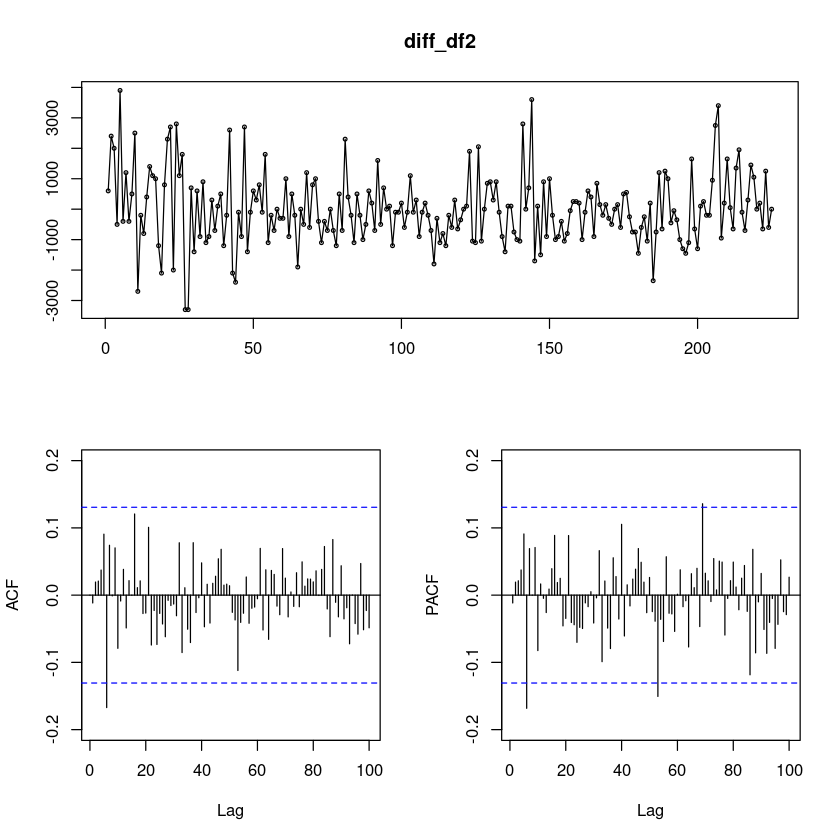

차분

- 확률적 추세가 존재해 보였으므로 차분을 진행하자.

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(df2, lags = 1, type = "c")

fUnitRoots::adfTest(df2, lags = 2, type = "c")

fUnitRoots::adfTest(df2, lags = 3, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -1.14

P VALUE:

0.6323

Description:

Wed Dec 13 22:57:07 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -1.1591

P VALUE:

0.6252

Description:

Wed Dec 13 22:57:07 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 3

STATISTIC:

Dickey-Fuller: -1.2014

P VALUE:

0.6095

Description:

Wed Dec 13 22:57:07 2023 by user: - adf test에서도 pvalue값이 크다. 즉 h0기각! 차분이 필요하다.

diff_df2 = diff(df2)

forecast::tsdisplay(diff_df2, lag.max=100)

t.test(diff_df2)

One Sample t-test

data: diff_df2

t = -0.12607, df = 224, p-value = 0.8998

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-162.6208 143.0652

sample estimates:

mean of x

-9.777778 평균은 0이다

1월 1일부터 11월 30일까지 108개의 결측값이 있음. 정말 많군!

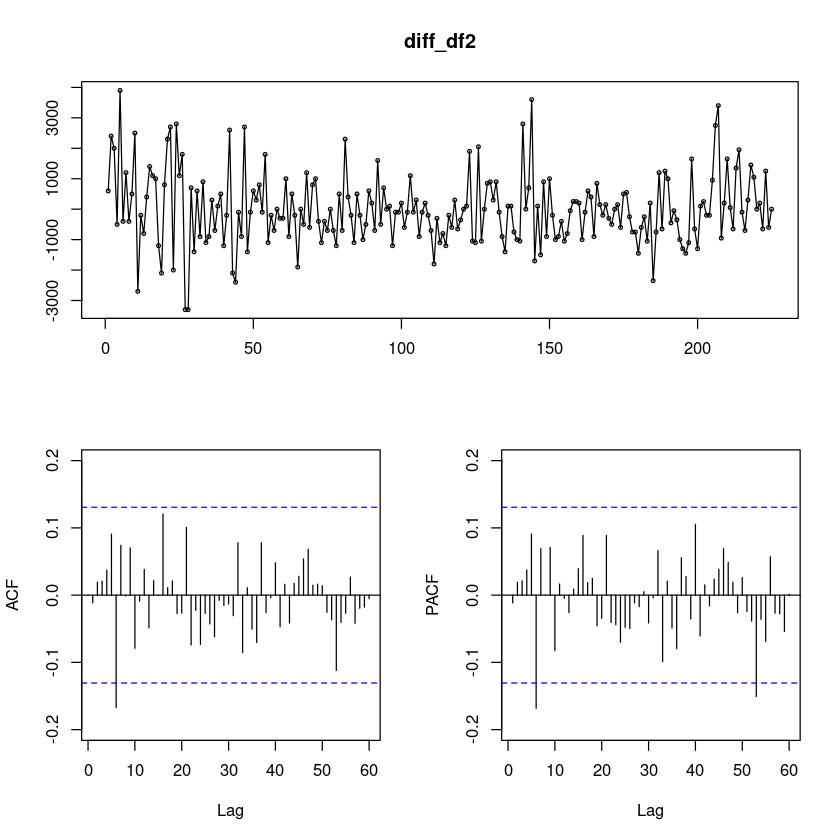

차분을 진행하였더니, 확률적 추세가 사라졌다.

시도표에서 계절성분이 따로 보이진 않는다.

ACF와 PACF도 1개 정도가 유효해 보인다..

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(diff_df2, lags = 1, type = "nc")

fUnitRoots::adfTest(diff_df2, lags = 2, type = "nc")

fUnitRoots::adfTest(diff_df2, lags = 3, type = "nc")

fUnitRoots::adfTest(diff_df2, lags = 6, type = "nc")Warning message in fUnitRoots::adfTest(diff_df2, lags = 1, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff_df2, lags = 2, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff_df2, lags = 3, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff_df2, lags = 6, type = "nc"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -10.5198

P VALUE:

0.01

Description:

Wed Dec 13 23:03:49 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -8.6005

P VALUE:

0.01

Description:

Wed Dec 13 23:03:49 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 3

STATISTIC:

Dickey-Fuller: -7.0735

P VALUE:

0.01

Description:

Wed Dec 13 23:03:49 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 6

STATISTIC:

Dickey-Fuller: -5.8189

P VALUE:

0.01

Description:

Wed Dec 13 23:03:49 2023 by user: 단위근 검정을 진행하음. 차분은 더이상 하지 않겠다.

카카오가 계속 하락장이라^^ 안타깝게도 모형적합이 잘될 거 같다.

모형식별

forecast::tsdisplay(diff_df2, lag.max=60)

fit0 = arima(diff_df2, order = c(1,1,0), include.mean=F)

summary(fit0)

lmtest::coeftest(fit0)

Call:

arima(x = diff_df2, order = c(1, 1, 0), include.mean = F)

Coefficients:

ar1

-0.5182

s.e. 0.0571

sigma^2 estimated as 2e+06: log likelihood = -1942.95, aic = 3889.91

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -6.585348 1410.98 1051.466 NaN Inf 0.8502833 -0.178563

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.518170 0.057091 -9.0763 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1fit1 = arima(diff_df2, order = c(1,0,0), include.mean=F)

summary(fit1)

lmtest::coeftest(fit1)

Call:

arima(x = diff_df2, order = c(1, 0, 0), include.mean = F)

Coefficients:

ar1

-0.0115

s.e. 0.0666

sigma^2 estimated as 1347443: log likelihood = -1907.05, aic = 3818.11

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -9.890129 1160.794 867.0039 NaN Inf 0.701115 9.321406e-05

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.011473 0.066555 -0.1724 0.8631- 하나도~ 유의하지 않아

fit112 = arima(df2, order = c(1,0,0))

summary(fit112)

lmtest::coeftest(fit112)

Call:

arima(x = df2, order = c(1, 0, 0))

Coefficients:

ar1 intercept

0.9843 52948.58

s.e. 0.0096 3929.22

sigma^2 estimated as 1334129: log likelihood = -1916.14, aic = 3838.28

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 2.352975 1155.045 862.7188 -0.049621 1.611583 0.9949345

ACF1

Training set -0.001427749

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 9.8426e-01 9.5836e-03 102.703 < 2.2e-16 ***

intercept 5.2949e+04 3.9292e+03 13.476 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1음……………………….

fit33 <- forecast::auto.arima(ts(df2, frequency=1),

test = "adf",

seasonal = FALSE, trace = T)

summary(fit33)

#lmtest::coeftest(fit33)

Fitting models using approximations to speed things up...

ARIMA(2,1,2) with drift : 3802.643

ARIMA(0,1,0) with drift : 3804.063

ARIMA(1,1,0) with drift : 3806.812

ARIMA(0,1,1) with drift : 3806.089

ARIMA(0,1,0) : 3802.043

ARIMA(1,1,1) with drift : Inf

Now re-fitting the best model(s) without approximations...

ARIMA(0,1,0) : 3816.157

Best model: ARIMA(0,1,0)

Series: ts(df2, frequency = 1)

ARIMA(0,1,0)

sigma^2 = 1347635: log likelihood = -1907.07

AIC=3816.14 AICc=3816.16 BIC=3819.56

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -9.501328 1158.305 863.5075 -0.04156467 1.609105 0.9958441

ACF1

Training set -0.0114756잔차분석

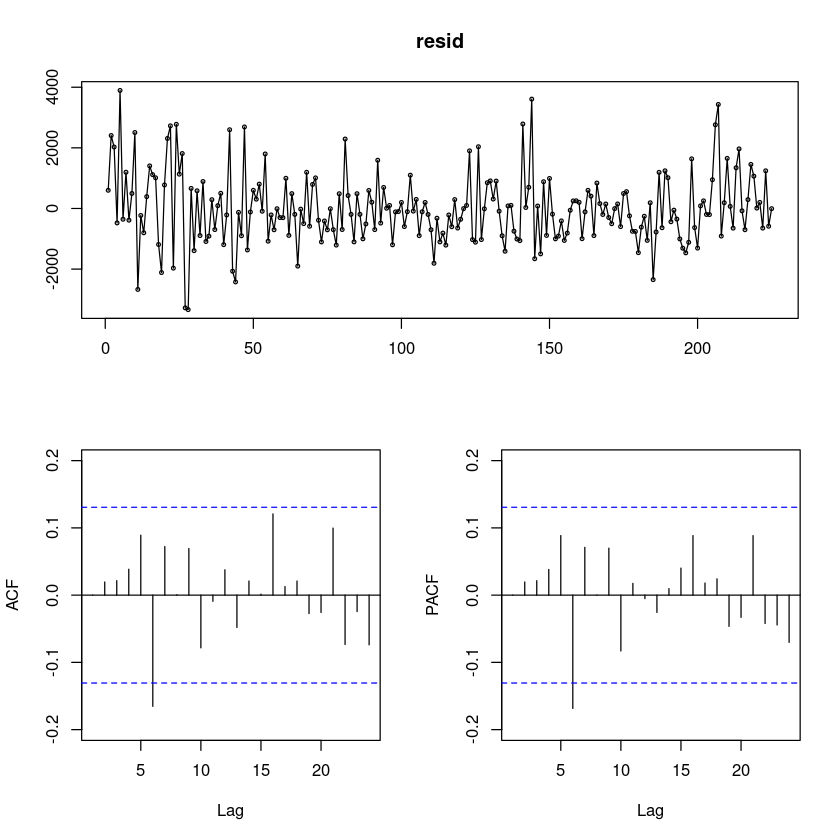

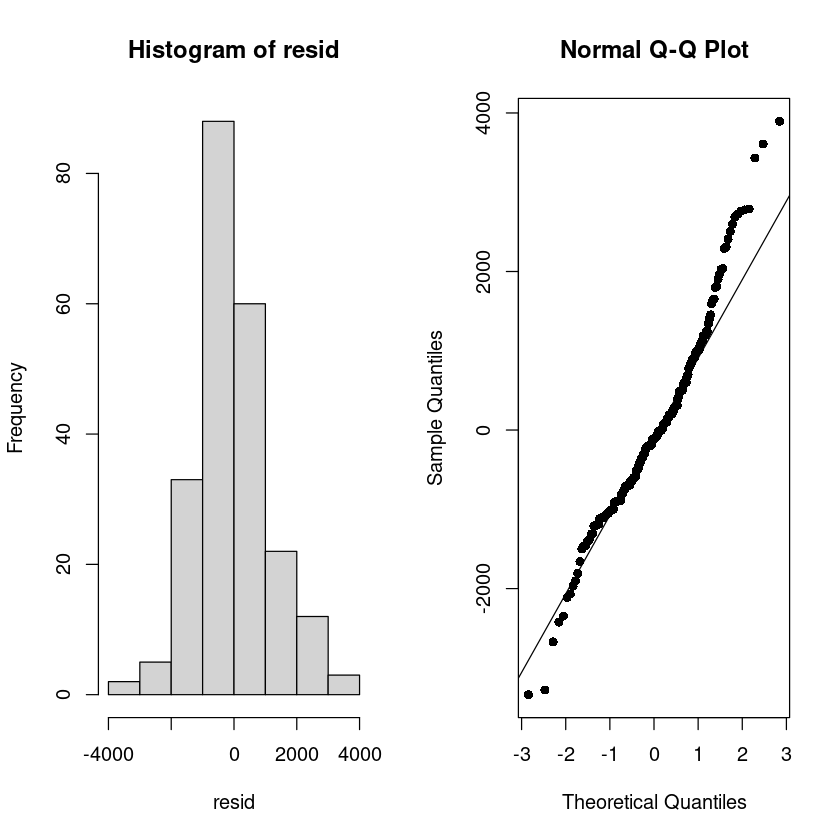

fit1

resid = resid(fit1)

forecast::tsdisplay(resid)

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal distribution

Jarque Bera Test

data: resid

X-squared = 22.4, df = 2, p-value = 1.368e-05par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

- 정규분포가 아니다. 주식 데이터 특성상.. 중간에 튀어나오는 몇개의 점들로 인해서 ..

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit1, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 8.757044 | 5 | 0.1191562 | |

| 12 | 12.933738 | 11 | 0.2976783 | |

| 18 | 17.311739 | 17 | 0.4334467 | |

| 24 | 23.038719 | 23 | 0.4585117 |

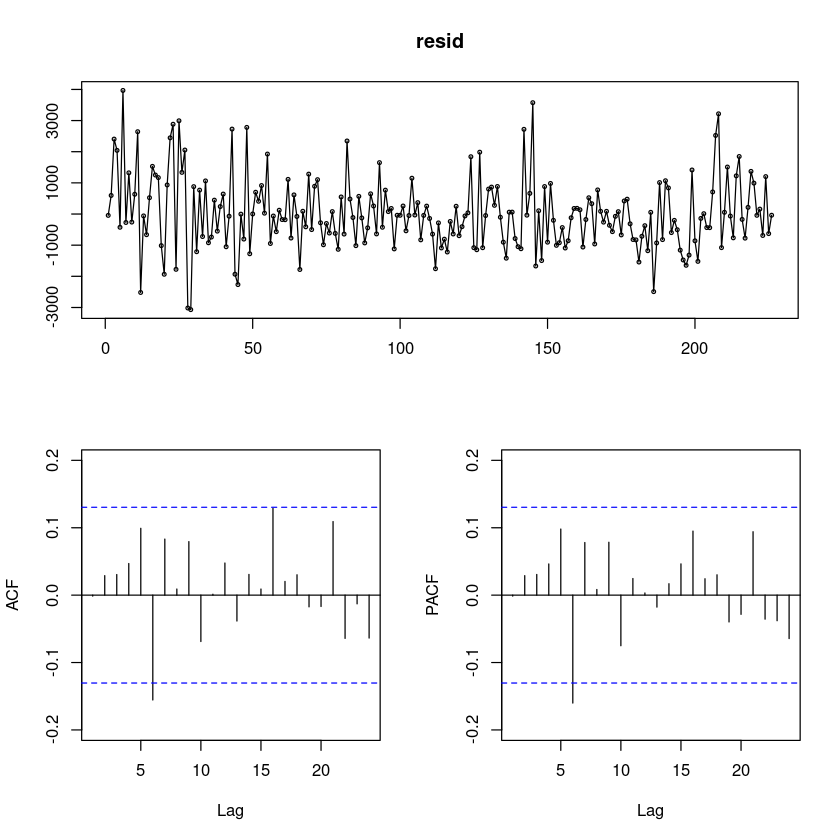

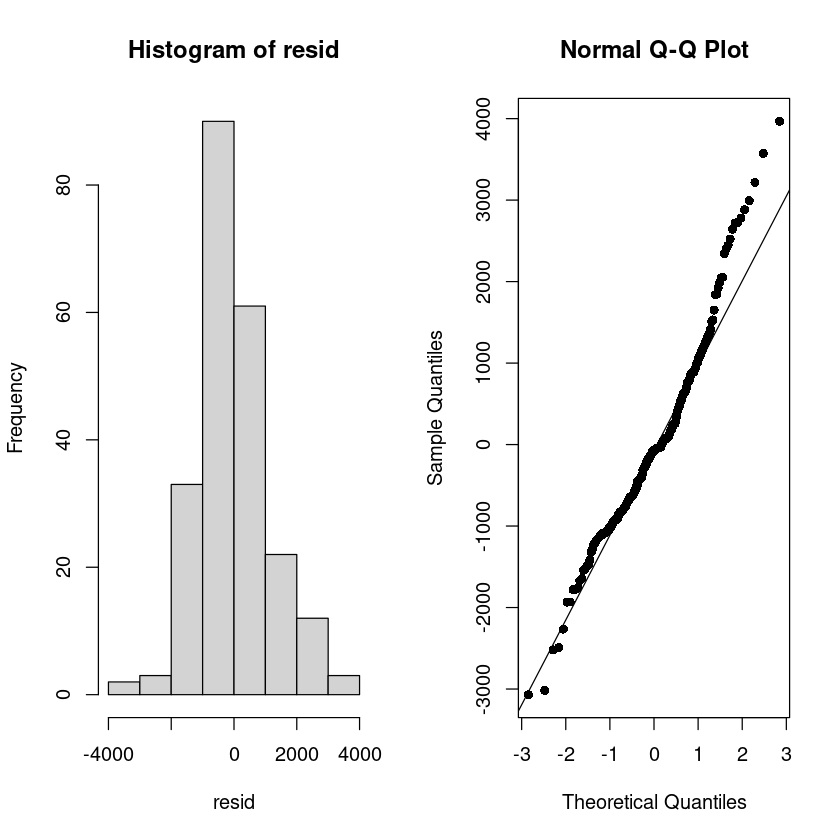

fit112

resid = resid(fit112)

forecast::tsdisplay(resid)

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal distribution

Jarque Bera Test

data: resid

X-squared = 23.582, df = 2, p-value = 7.572e-06par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

- 정규분포가 아니다. 주식 데이터 특성상.. 중간에 튀어나오는 몇개의 점들로 인해서 ..

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit112, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 8.877486 | 5 | 0.1140518 | |

| 12 | 13.696612 | 11 | 0.2502380 | |

| 18 | 18.704037 | 17 | 0.3457823 | |

| 24 | 23.960522 | 23 | 0.4059972 |

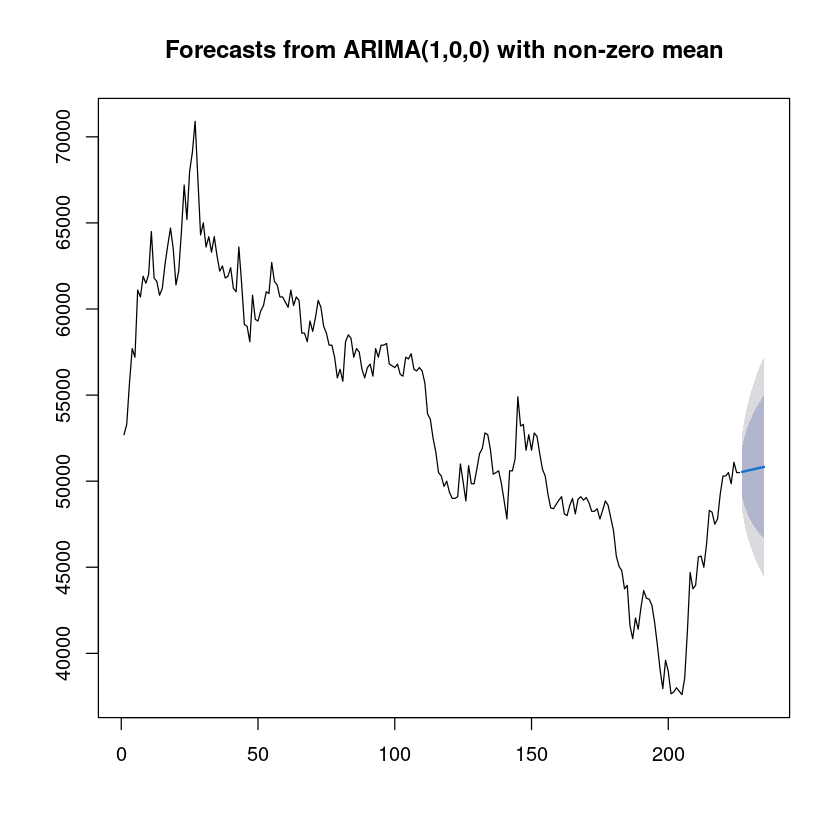

forecast_fit <- forecast::forecast(fit112, 9)

forecast_fit

plot(forecast_fit) Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

227 50538.54 49058.29 52018.79 48274.69 52802.38

228 50576.47 48499.48 52653.45 47400.00 53752.93

229 50613.80 48089.86 53137.74 46753.76 54473.83

230 50650.54 47758.75 53542.34 46227.92 55073.16

231 50686.71 47478.52 53894.90 45780.21 55593.21

232 50722.31 47234.87 54209.74 45388.74 56055.88

233 50757.34 47019.22 54495.46 45040.38 56474.30

234 50791.83 46825.94 54757.72 44726.52 56857.14

235 50825.77 46651.05 55000.49 44441.09 57210.45

predict12 <- c(49700,50800,50800,50500,50500,51700,52100,51800,50900)mean(forecast_fit$mean - predict12)^2mean((as.numeric(forecast_fit$predict12) - predict12)^2)astsa::sarima.for(df2,5,1,0,0)- $pred

- A Time Series:

- 50538.5358209821

- 50576.4651645273

- 50613.7975753884

- 50650.5424481026

- 50686.7090293556

- $se

- A Time Series:

- 1155.04493165446

- 1620.67731112801

- 1969.44142171338

- 2256.48020601875

- 2503.36298433091

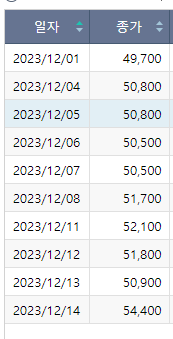

tail(kakao)| 일자 | 종가 | 대비 | 등락률 | 시가 | 고가 | 저가 | 거래량 | 거래대금 | 시가총액 | 상장주식수 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 225 | 2023/11/29 | 50500 | -600 | -1.17 | 50800 | 51300 | 50100 | 1284120 | 65153113600 | 2.244705e+13 | 444495970 |

| 226 | 2023/11/30 | 50500 | 0 | 0.00 | 50200 | 50900 | 50000 | 1613598 | 81271347200 | 2.244705e+13 | 444495970 |

| 227 | 2023/12/01 | 49700 | -800 | -1.58 | 50400 | 50400 | 49650 | 1105367 | 55174771850 | 2.209145e+13 | 444495970 |

| 228 | 2023/12/04 | 50800 | 1100 | 2.21 | 49800 | 51300 | 49750 | 1785113 | 90624610300 | 2.258040e+13 | 444495970 |

| 229 | 2023/12/05 | 50800 | 0 | 0.00 | 50700 | 51200 | 50200 | 1142447 | 57992282100 | 2.258040e+13 | 444495970 |

| 230 | 2023/12/06 | 50900 | 100 | 0.20 | 50700 | 51100 | 50200 | 735503 | 37302792200 | 2.262484e+13 | 444495970 |

- 평균 값으로 수렴쓰

짧은 예측은.. 당연히 잘할듯.

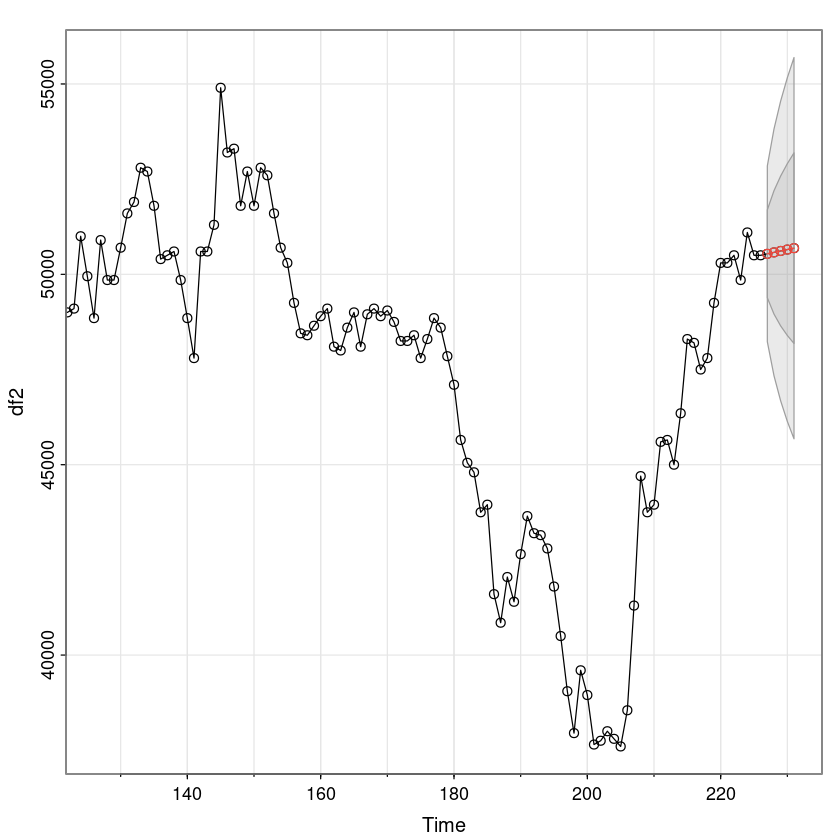

train/test 나누어서 분석 해볼까?

train: 1 ~ 8월

test: 9 ~ 11월

train_data <- df[df$일자 >= as.Date("2023-01-01") & df$일자 <= as.Date("2023-08-31"), ]

test_data <- df[df$일자 >= as.Date("2023-09-01") & df$일자 <= as.Date("2023-11-30"), ]tr <- train_data[c('일자','종가')] # 166개

ts <- test_data[c('일자','종가')] # 60개t <- 1:166

tr <- train_data$종가

ts <- test_data$종가

ddd <- c(tr,ts)plot(1:166, ddd[1:166], type = "l", col = "blue", lwd = 2,

xlab = "Time", ylab = "Value", main = "Train, Test Time Series",xlim = c(1, 230), ylim=range(c(tr,ts)))

lines(167:266, ddd[167:266], col = "red", lwd = 2)

legend("topright", legend = c("Train", "Test"), col = c("blue", "red"), lwd = 2)

fitc <- lm(tr ~ t)

summary(fitc)

Call:

lm(formula = tr ~ t)

Residuals:

Min 1Q Median 3Q Max

-12020.9 -1322.0 476.5 1581.1 8650.3

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 64815.958 418.727 154.79 <2e-16 ***

t -95.047 4.349 -21.85 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2685 on 164 degrees of freedom

Multiple R-squared: 0.7444, Adjusted R-squared: 0.7428

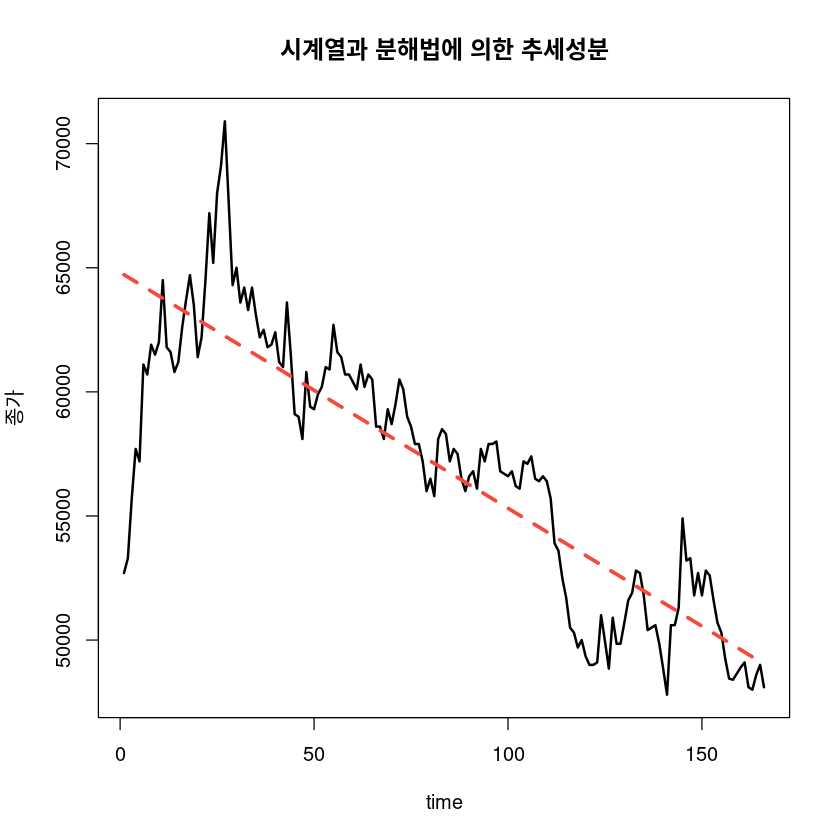

F-statistic: 477.6 on 1 and 164 DF, p-value: < 2.2e-16- \(\hat T_t = 64815.958 - 95.047t\)

hatT <- fitted(fitc)

ts.plot(ts(tr), hatT,

col=1:2,

lty=1:2,

lwd=2:3,

ylab="종가", xlab="time",

main="시계열과 분해법에 의한 추세성분")

#legend("topleft", lty=1:2, col=1:2, lwd=2:3, c("tr", "추세성분"))

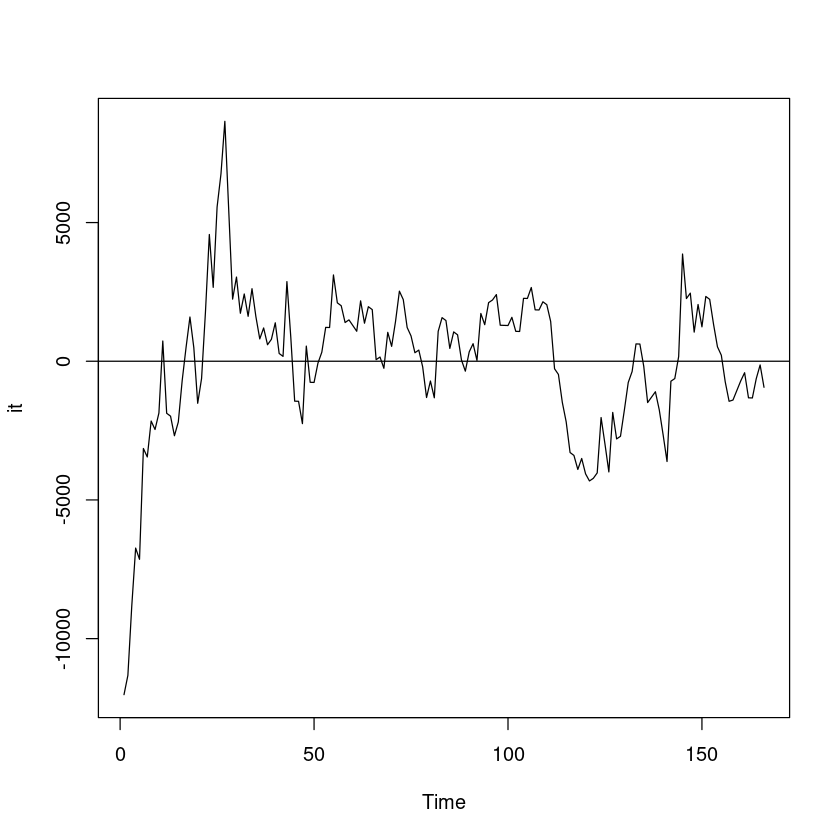

it <- tr - hatT

ts.plot(it);abline(h=0)

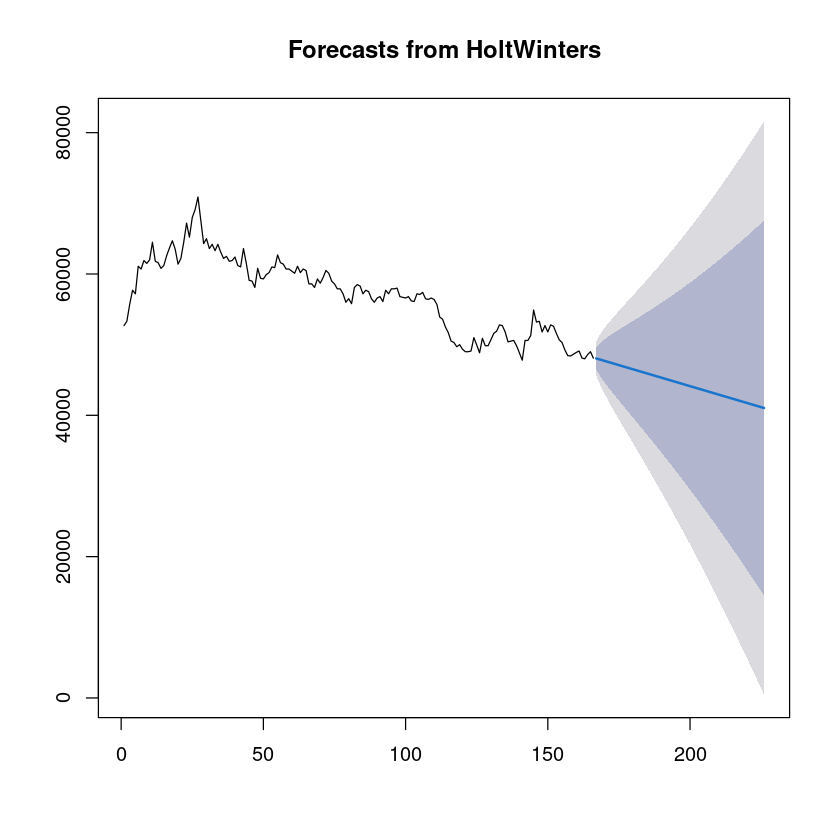

- 이중지수평활

fit2 <- HoltWinters(tr, gamma = FALSE)

fit2Holt-Winters exponential smoothing with trend and without seasonal component.

Call:

HoltWinters(x = tr, gamma = FALSE)

Smoothing parameters:

alpha: 0.9032017

beta : 0.04464006

gamma: FALSE

Coefficients:

[,1]

a 48173.0848

b -118.9456summary(fit2)

Forecast method: HoltWinters

Model Information:

Holt-Winters exponential smoothing with trend and without seasonal component.

Call:

HoltWinters(x = tr, gamma = FALSE)

Smoothing parameters:

alpha: 0.9032017

beta : 0.04464006

gamma: FALSE

Coefficients:

[,1]

a 48173.0848

b -118.9456

Error measures:

ME RMSE MAE MPE MAPE MASE

Training set -108.7283 1212.111 896.0274 -0.1880653 1.554758 0.9962569

ACF1

Training set -0.01007322

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

167 48054.14 46502.28 49606.00 45680.7752 50427.50

168 47935.19 45801.61 50068.78 44672.1578 51198.23

169 47816.25 45192.65 50439.84 43803.8082 51828.69

170 47697.30 44629.85 50764.76 43006.0357 52388.57

171 47578.36 44094.38 51062.34 42250.0696 52906.64

172 47459.41 43576.42 51342.40 41520.8951 53397.93

173 47340.47 43070.16 51610.77 40809.5942 53871.34

174 47221.52 42571.82 51871.22 40110.4102 54332.63

175 47102.57 42078.82 52126.33 39419.4050 54785.74

176 46983.63 41589.33 52377.92 38733.7668 55233.49

177 46864.68 41102.00 52627.37 38051.4211 55677.94

178 46745.74 40615.79 52875.68 37370.7974 56120.68

179 46626.79 40129.92 53123.66 36690.6820 56562.90

180 46507.85 39643.75 53371.94 36010.1211 57005.57

181 46388.90 39156.80 53621.00 35328.3547 57449.45

182 46269.95 38668.66 53871.25 34644.7701 57895.14

183 46151.01 38179.00 54123.02 33958.8689 58343.15

184 46032.06 37687.56 54376.57 33270.2424 58793.88

185 45913.12 37194.11 54632.12 32578.5530 59247.68

186 45794.17 36698.49 54889.86 31883.5209 59704.82

187 45675.23 36200.52 55149.93 31184.9128 60165.54

188 45556.28 35700.09 55412.47 30482.5338 60630.03

189 45437.34 35197.08 55677.59 29776.2207 61098.45

190 45318.39 34691.42 55945.36 29065.8365 61570.94

191 45199.44 34183.01 56215.88 28351.2665 62047.62

192 45080.50 33671.81 56489.19 27632.4145 62528.58

193 44961.55 33157.75 56765.35 26909.2003 63013.91

194 44842.61 32640.80 57044.41 26181.5568 63503.66

195 44723.66 32120.92 57326.41 25449.4287 63997.89

196 44604.72 31598.07 57611.36 24712.7703 64496.66

197 44485.77 31072.24 57899.30 23971.5446 65000.00

198 44366.82 30543.40 58190.25 23225.7216 65507.93

199 44247.88 30011.54 58484.22 22475.2779 66020.48

200 44128.93 29476.65 58781.22 21720.1955 66537.67

201 44009.99 28938.71 59081.26 20960.4613 67059.51

202 43891.04 28397.73 59384.35 20196.0661 67586.02

203 43772.10 27853.70 59690.50 19427.0046 68117.19

204 43653.15 27306.61 59999.69 18653.2745 68653.03

205 43534.21 26756.47 60311.94 17874.8764 69193.53

206 43415.26 26203.28 60627.24 17091.8132 69738.71

207 43296.31 25647.05 60945.58 16304.0901 70288.54

208 43177.37 25087.77 61266.97 15511.7139 70843.02

209 43058.42 24525.45 61591.39 14714.6934 71402.15

210 42939.48 23960.11 61918.85 13913.0384 71965.92

211 42820.53 23391.74 62249.32 13106.7603 72534.30

212 42701.59 22820.36 62582.81 12295.8715 73107.30

213 42582.64 22245.97 62919.31 11480.3852 73684.90

214 42463.69 21668.58 63258.81 10660.3157 74267.07

215 42344.75 21088.21 63601.29 9835.6777 74853.82

216 42225.80 20504.86 63946.75 9006.4868 75445.12

217 42106.86 19918.54 64295.17 8172.7591 76040.96

218 41987.91 19329.27 64646.55 7334.5109 76641.31

219 41868.97 18737.05 65000.88 6491.7593 77246.17

220 41750.02 18141.90 65358.14 5644.5214 77855.52

221 41631.08 17543.83 65718.32 4792.8147 78469.34

222 41512.13 16942.85 66081.41 3936.6571 79087.60

223 41393.18 16338.97 66447.40 3076.0664 79710.30

224 41274.24 15732.20 66816.28 2211.0606 80337.42

225 41155.29 15122.56 67188.03 1341.6581 80968.93

226 41036.35 14510.05 67562.64 467.8771 81604.82fit2=forecast(fit2, h=60)

fit2

plot(fit2) Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

167 48054.14 46502.28 49606.00 45680.7752 50427.50

168 47935.19 45801.61 50068.78 44672.1578 51198.23

169 47816.25 45192.65 50439.84 43803.8082 51828.69

170 47697.30 44629.85 50764.76 43006.0357 52388.57

171 47578.36 44094.38 51062.34 42250.0696 52906.64

172 47459.41 43576.42 51342.40 41520.8951 53397.93

173 47340.47 43070.16 51610.77 40809.5942 53871.34

174 47221.52 42571.82 51871.22 40110.4102 54332.63

175 47102.57 42078.82 52126.33 39419.4050 54785.74

176 46983.63 41589.33 52377.92 38733.7668 55233.49

177 46864.68 41102.00 52627.37 38051.4211 55677.94

178 46745.74 40615.79 52875.68 37370.7974 56120.68

179 46626.79 40129.92 53123.66 36690.6820 56562.90

180 46507.85 39643.75 53371.94 36010.1211 57005.57

181 46388.90 39156.80 53621.00 35328.3547 57449.45

182 46269.95 38668.66 53871.25 34644.7701 57895.14

183 46151.01 38179.00 54123.02 33958.8689 58343.15

184 46032.06 37687.56 54376.57 33270.2424 58793.88

185 45913.12 37194.11 54632.12 32578.5530 59247.68

186 45794.17 36698.49 54889.86 31883.5209 59704.82

187 45675.23 36200.52 55149.93 31184.9128 60165.54

188 45556.28 35700.09 55412.47 30482.5338 60630.03

189 45437.34 35197.08 55677.59 29776.2207 61098.45

190 45318.39 34691.42 55945.36 29065.8365 61570.94

191 45199.44 34183.01 56215.88 28351.2665 62047.62

192 45080.50 33671.81 56489.19 27632.4145 62528.58

193 44961.55 33157.75 56765.35 26909.2003 63013.91

194 44842.61 32640.80 57044.41 26181.5568 63503.66

195 44723.66 32120.92 57326.41 25449.4287 63997.89

196 44604.72 31598.07 57611.36 24712.7703 64496.66

197 44485.77 31072.24 57899.30 23971.5446 65000.00

198 44366.82 30543.40 58190.25 23225.7216 65507.93

199 44247.88 30011.54 58484.22 22475.2779 66020.48

200 44128.93 29476.65 58781.22 21720.1955 66537.67

201 44009.99 28938.71 59081.26 20960.4613 67059.51

202 43891.04 28397.73 59384.35 20196.0661 67586.02

203 43772.10 27853.70 59690.50 19427.0046 68117.19

204 43653.15 27306.61 59999.69 18653.2745 68653.03

205 43534.21 26756.47 60311.94 17874.8764 69193.53

206 43415.26 26203.28 60627.24 17091.8132 69738.71

207 43296.31 25647.05 60945.58 16304.0901 70288.54

208 43177.37 25087.77 61266.97 15511.7139 70843.02

209 43058.42 24525.45 61591.39 14714.6934 71402.15

210 42939.48 23960.11 61918.85 13913.0384 71965.92

211 42820.53 23391.74 62249.32 13106.7603 72534.30

212 42701.59 22820.36 62582.81 12295.8715 73107.30

213 42582.64 22245.97 62919.31 11480.3852 73684.90

214 42463.69 21668.58 63258.81 10660.3157 74267.07

215 42344.75 21088.21 63601.29 9835.6777 74853.82

216 42225.80 20504.86 63946.75 9006.4868 75445.12

217 42106.86 19918.54 64295.17 8172.7591 76040.96

218 41987.91 19329.27 64646.55 7334.5109 76641.31

219 41868.97 18737.05 65000.88 6491.7593 77246.17

220 41750.02 18141.90 65358.14 5644.5214 77855.52

221 41631.08 17543.83 65718.32 4792.8147 78469.34

222 41512.13 16942.85 66081.41 3936.6571 79087.60

223 41393.18 16338.97 66447.40 3076.0664 79710.30

224 41274.24 15732.20 66816.28 2211.0606 80337.42

225 41155.29 15122.56 67188.03 1341.6581 80968.93

226 41036.35 14510.05 67562.64 467.8771 81604.82

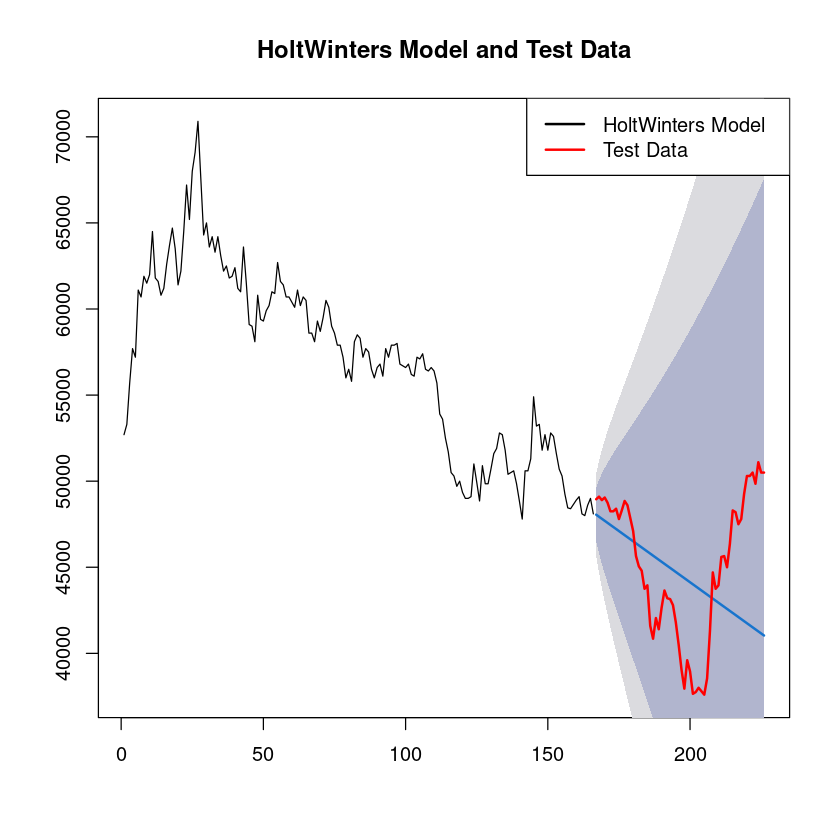

plot(fit2, main = "HoltWinters Model and Test Data", ylim=range(c(tr,ts)))

lines(length(tr) + 1:length(ts), ts, col = "red", lwd = 2)

# 범례 추가

legend("topright", legend = c("HoltWinters Model", "Test Data"), col = c("black", "red"), lwd = 2)

mean((as.numeric(fit2$mean) - ts)^2)fore_fit3 <- forecast::auto.arima(ts(tr, frequency=1),

test = "adf",

seasonal = FALSE, trace = T)

fit3 <- forecast::forecast(fore_fit3,60)

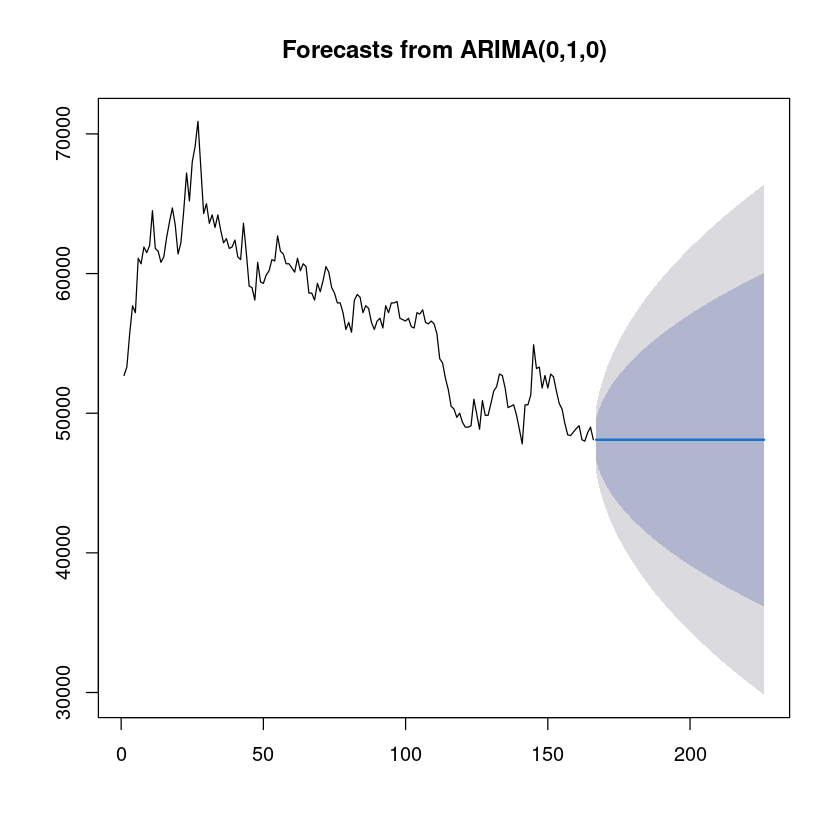

plot(fit3)

Fitting models using approximations to speed things up...

ARIMA(2,1,2) with drift : Inf

ARIMA(0,1,0) with drift : 2798.421

ARIMA(1,1,0) with drift : 2800.201

ARIMA(0,1,1) with drift : 2799.537

ARIMA(0,1,0) : 2796.46

ARIMA(1,1,1) with drift : Inf

Now re-fitting the best model(s) without approximations...

ARIMA(0,1,0) : 2810.644

Best model: ARIMA(0,1,0)

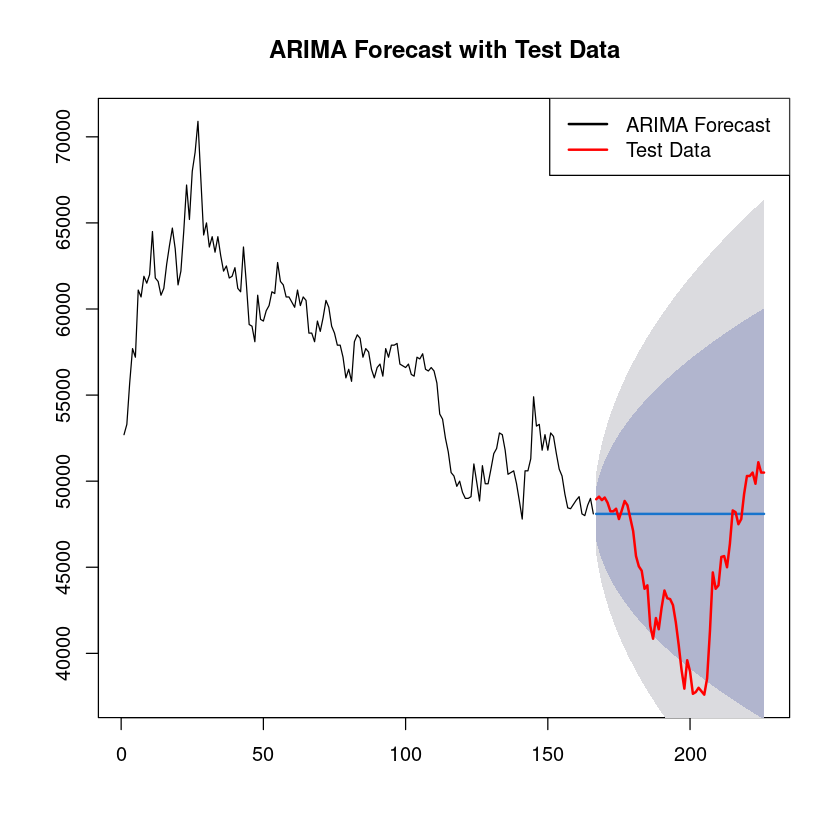

plot(fit3, main = "ARIMA Forecast with Test Data", ylim=range(c(tr,ts)))

lines(length(tr) + 1:length(ts), ts, col = "red", lwd = 2)

legend("topright", legend = c("ARIMA Forecast", "Test Data"), col = c("black", "red"), lwd = 2)

mean((as.numeric(fit3$mean) - ts)^2)summary(fit3)

Forecast method: ARIMA(0,1,0)

Model Information:

Series: ts(tr, frequency = 1)

ARIMA(0,1,0)

sigma^2 = 1445653: log likelihood = -1404.31

AIC=2810.62 AICc=2810.64 BIC=2813.73

Error measures:

ME RMSE MAE MPE MAPE MASE

Training set -27.39337 1198.726 894.2934 -0.0754439 1.549295 0.9943289

ACF1

Training set -0.07825018

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

167 48100 46559.12 49640.88 45743.43 50456.57

168 48100 45920.87 50279.13 44767.31 51432.69

169 48100 45431.12 50768.88 44018.30 52181.70

170 48100 45018.24 51181.76 43386.86 52813.14

171 48100 44654.49 51545.51 42830.55 53369.45

172 48100 44325.64 51874.36 42327.61 53872.39

173 48100 44023.22 52176.78 41865.10 54334.90

174 48100 43741.74 52458.26 41434.62 54765.38

175 48100 43477.37 52722.63 41030.29 55169.71

176 48100 43227.32 52972.68 40647.87 55552.13

177 48100 42989.49 53210.51 40284.14 55915.86

178 48100 42762.24 53437.76 39936.61 56263.39

179 48100 42544.29 53655.71 39603.27 56596.73

180 48100 42334.56 53865.44 39282.53 56917.47

181 48100 42132.21 54067.79 38973.05 57226.95

182 48100 41936.49 54263.51 38673.72 57526.28

183 48100 41746.80 54453.20 38383.62 57816.38

184 48100 41562.61 54637.39 38101.92 58098.08

185 48100 41383.47 54816.53 37827.95 58372.05

186 48100 41208.99 54991.01 37561.10 58638.90

187 48100 41038.81 55161.19 37300.84 58899.16

188 48100 40872.64 55327.36 37046.71 59153.29

189 48100 40710.21 55489.79 36798.29 59401.71

190 48100 40551.27 55648.73 36555.22 59644.78

191 48100 40395.61 55804.39 36317.16 59882.84

192 48100 40243.03 55956.97 36083.81 60116.19

193 48100 40093.37 56106.63 35854.91 60345.09

194 48100 39946.44 56253.56 35630.21 60569.79

195 48100 39802.12 56397.88 35409.49 60790.51

196 48100 39660.27 56539.73 35192.54 61007.46

197 48100 39520.76 56679.24 34979.18 61220.82

198 48100 39383.48 56816.52 34769.23 61430.77

199 48100 39248.33 56951.67 34562.54 61637.46

200 48100 39115.22 57084.78 34358.96 61841.04

201 48100 38984.05 57215.95 34158.35 62041.65

202 48100 38854.73 57345.27 33960.59 62239.41

203 48100 38727.21 57472.79 33765.55 62434.45

204 48100 38601.39 57598.61 33573.13 62626.87

205 48100 38477.22 57722.78 33383.23 62816.77

206 48100 38354.63 57845.37 33195.75 63004.25

207 48100 38233.57 57966.43 33010.60 63189.40

208 48100 38113.97 58086.03 32827.69 63372.31

209 48100 37995.79 58204.21 32646.94 63553.06

210 48100 37878.97 58321.03 32468.29 63731.71

211 48100 37763.48 58436.52 32291.65 63908.35

212 48100 37649.26 58550.74 32116.97 64083.03

213 48100 37536.28 58663.72 31944.18 64255.82

214 48100 37424.49 58775.51 31773.21 64426.79

215 48100 37313.86 58886.14 31604.02 64595.98

216 48100 37204.35 58995.65 31436.54 64763.46

217 48100 37095.93 59104.07 31270.73 64929.27

218 48100 36988.57 59211.43 31106.54 65093.46

219 48100 36882.24 59317.76 30943.92 65256.08

220 48100 36776.91 59423.09 30782.83 65417.17

221 48100 36672.55 59527.45 30623.22 65576.78

222 48100 36569.13 59630.87 30465.05 65734.95

223 48100 36466.63 59733.37 30308.29 65891.71

224 48100 36365.03 59834.97 30152.91 66047.09

225 48100 36264.29 59935.71 29998.85 66201.15

226 48100 36164.41 60035.59 29846.10 66353.90어 렵 다

data na값..

date_na <- as.Date(date_na, format = "%Y/%m/%d")

miss_row <- data.frame(일자 = date_na, 종가 = NA)

df3 <- head(kakao[c("일자","종가")],226)

df3$일자<- as.Date(df3$일자, format = "%Y/%m/%d")

df4 <- bind_rows(df3, miss_row)

df4 <- df4[order(df4$일자),, drop=FALSE]

rownames(df4) <- NULL

head(df4)| 일자 | 종가 | |

|---|---|---|

| <date> | <int> | |

| 1 | 2023-01-01 | NA |

| 2 | 2023-01-02 | 52700 |

| 3 | 2023-01-03 | 53300 |

| 4 | 2023-01-04 | 55700 |

| 5 | 2023-01-05 | 57700 |

| 6 | 2023-01-06 | 57200 |

이제 여기서 NA값을 어떻게 할까?

일단.. 1월 1일거의 초기값은 넣어주는게 좋겠다. 22년 12웖 말 53,100원

시계열데이터에서 결측값을 처리하는 방법

na.locf,zoo::na.approx함수를 이용하여 결측값 채우기

na.locf: 앞쪽 값으로 결측값 채우기

zoo::na.approx: 선형 보간으로 결측값 채우기

- 평균값이나 중간값으로 채우기

zoo::na.aggregate(ts_with_na, FUN = mean, na.rm = TRUE)

zoo::na.aggregate(ts_with_na, FUN = median, na.rm = TRUE)

시계열 예측 모델 사용

결측값 삭제

1. 결측값 채우기(na.locf)

df4[1,]$종가 <- 53100df_l <- na.locf(df4$종가)forecast::tsdisplay(df_l,lag.max=100)

- 계절성분이 너무나 없다 ㅎ 그냥 일자로 하는거랑 비슷해보인다리?

2. 결측값 채우기(평균값!)

df_m <- df4

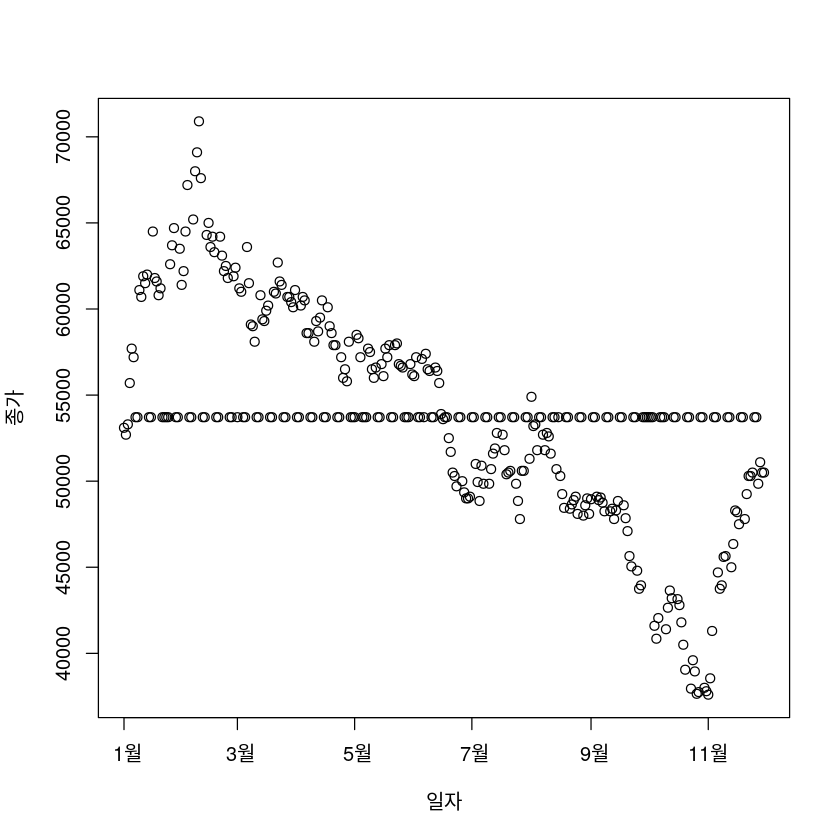

df_m$종가 <- zoo::na.aggregate(df4$종가, FUN = mean, na.rm = TRUE)plot(df_m)

—> 이건 누가 봐도 이상함 ㅎ

3. 결측값 채우기 (Nna.approx)

df_a <- na.approx(df4$종가)df_aa <- df4

df_aa$종가 <- df_aforecast::tsdisplay(df_a)

비슷하다.

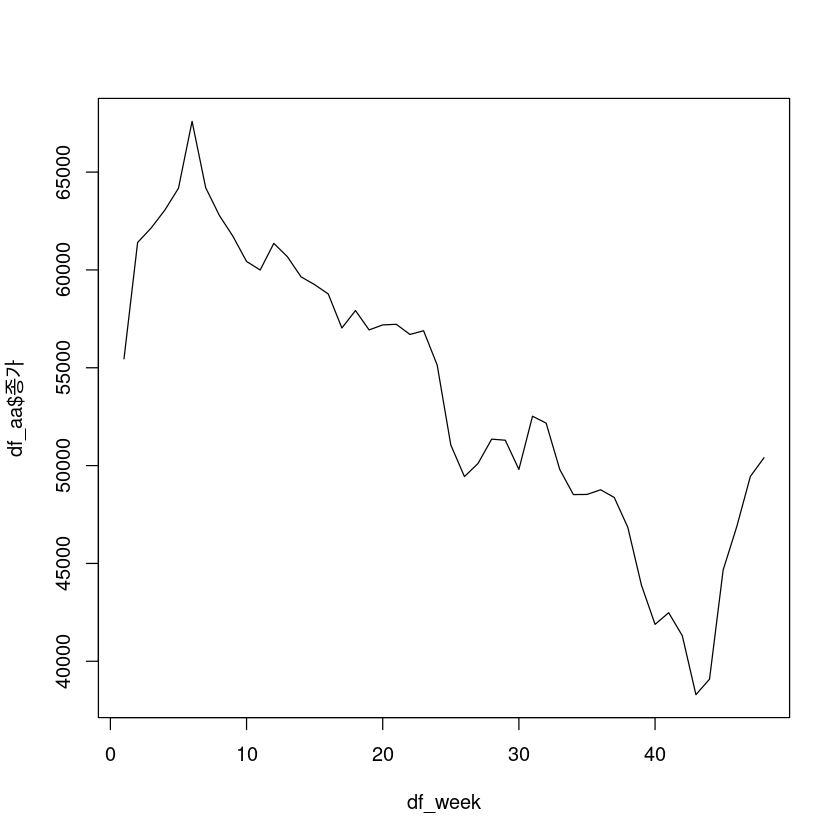

그냥 해보기.. (주별/월별 데이터로 바꾸기.)

df_week <- lubridate::week(df4$일자)

weekly_avg <- aggregate(df_aa$종가 ~ df_week, data = df_aa, FUN = mean)

head(weekly_avg)| df_week | df_aa$종가 | |

|---|---|---|

| <dbl> | <dbl> | |

| 1 | 1 | 55457.14 |

| 2 | 2 | 61404.76 |

| 3 | 3 | 62149.52 |

| 4 | 4 | 63060.00 |

| 5 | 5 | 64176.19 |

| 6 | 6 | 67595.24 |

plot(weekly_avg, type="l")

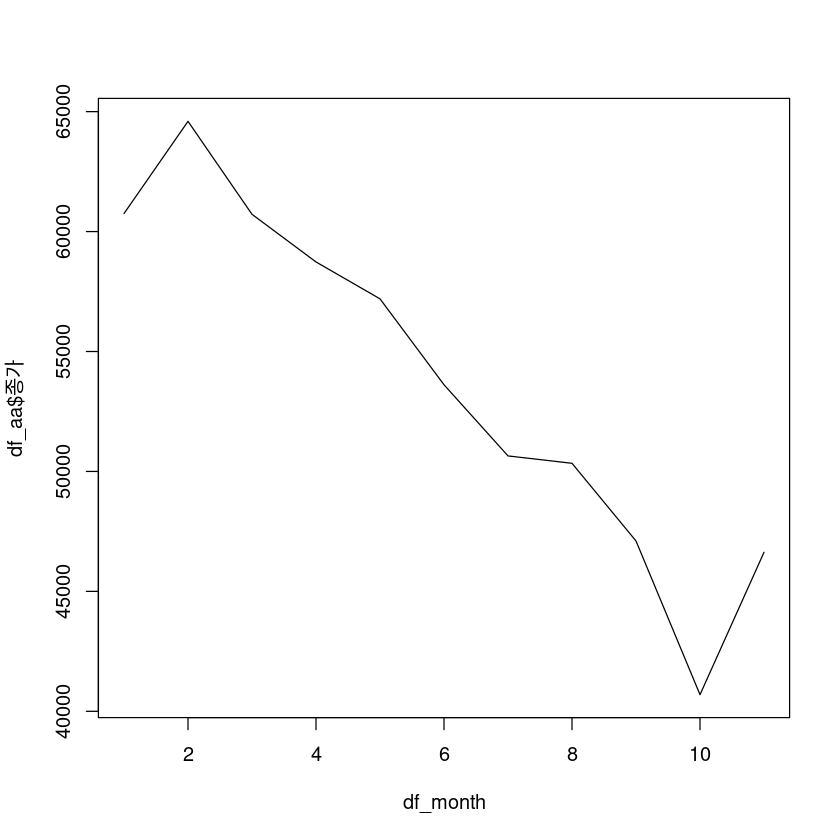

df_month <- lubridate::month(df4$일자)

monthly_avg <- aggregate(df_aa$종가 ~ df_month, data = df_aa, FUN = mean)plot(monthly_avg, type="l")

결론

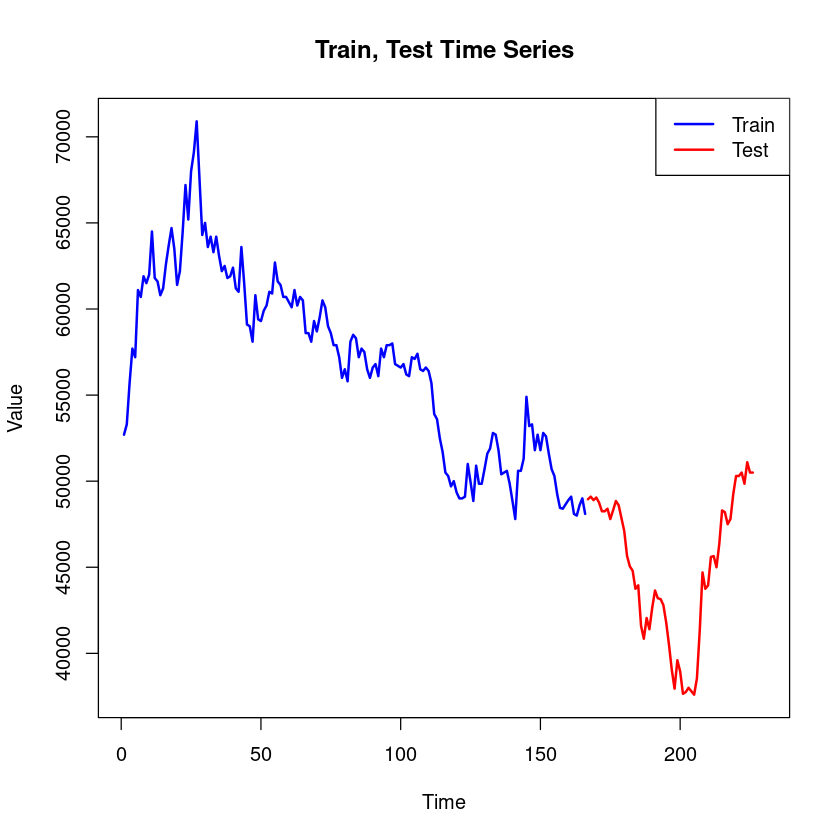

- 주식에서 단기예측은 그나마.. 조금 해볼만 하지만 장기예측은 택도 없을듯! 카카오 데이터가 너무나 하락세 ㅎ 여서 그나마 AR모형이 적합된거 같다. 그거 아니고서느…………..답이없어..

번외(내 주식은 어떘을까?)

kakao2021 <- read.csv("kakao2021.csv", fileEncoding = "ISO-8859-1")colnames(kakao2021) <- c("일자","종가","대비","등락률","시가","고가","저가","거래량","거래대금","시가총액","상장주식수")kakao2021 <- kakao2021[order(kakao2021$일자),]

rownames(kakao2021) <- NULL

head(kakao2021)| 일자 | 종가 | 대비 | 등락률 | 시가 | 고가 | 저가 | 거래량 | 거래대금 | 시가총액 | 상장주식수 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 1 | 2021/06/01 | 127000 | 4000 | 3.25 | 123500 | 127000 | 123000 | 3573808 | 449927782750 | 5.636986e+13 | 443857175 |

| 2 | 2021/06/02 | 127000 | 0 | 0.00 | 128000 | 129500 | 126000 | 2597446 | 330839738000 | 5.636986e+13 | 443857175 |

| 3 | 2021/06/03 | 126500 | -500 | -0.39 | 127500 | 128500 | 126000 | 1737466 | 220943599000 | 5.614793e+13 | 443857175 |

| 4 | 2021/06/04 | 124000 | -2500 | -1.98 | 126000 | 126000 | 123000 | 2668254 | 331077517000 | 5.503829e+13 | 443857175 |

| 5 | 2021/06/07 | 126000 | 2000 | 1.61 | 125000 | 127000 | 125000 | 1905198 | 239819945000 | 5.592600e+13 | 443857175 |

| 6 | 2021/06/08 | 128500 | 2500 | 1.98 | 127000 | 128500 | 126500 | 2248373 | 287596903000 | 5.703565e+13 | 443857175 |

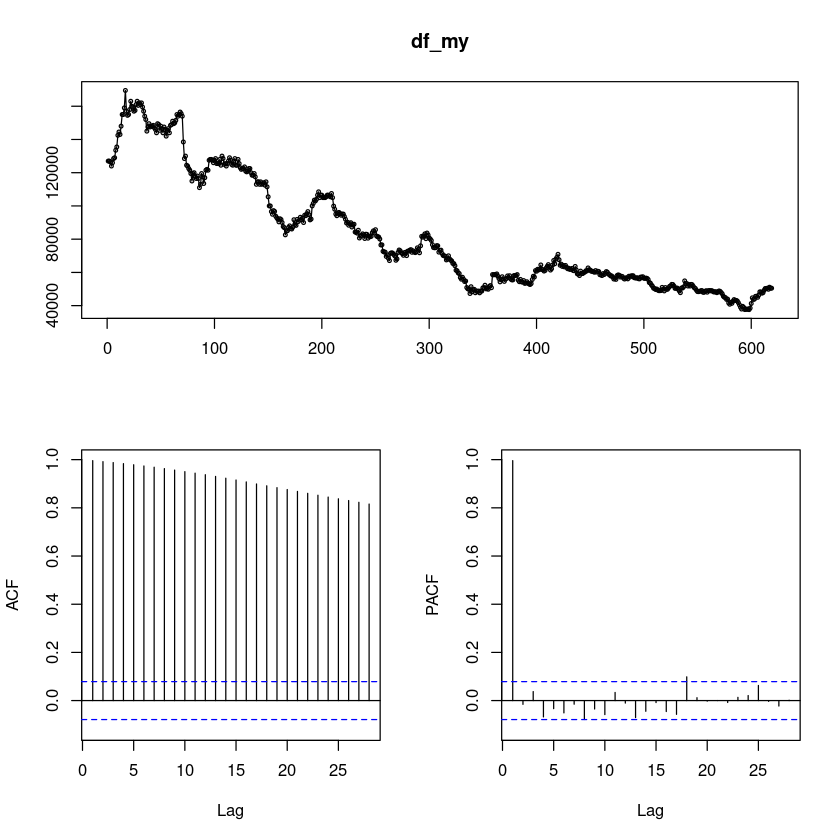

df_my <- kakao2021$종가forecast::tsdisplay(df_my)

ㅠㅠㅠㅠ

!

!

이미지출처: https://vizibusy.tistory.com/31

오르는 거 보고 신나서 들어갔다가 지금 현재 폭망하는 중……………………………